Here is a lo-fidelity version of the trailer to portrait the essence of the show.

A documentary-style reality show. A financial consultant, offers his/her expertise to people during real life events like Weddings, Buying a house, Starting a Business, etc., struggling with financial problems. They give ways to tackle the situation in real time and also tell the viewers about possible ways to plan for such contingencies

Gen Z

It incorporates a number of stakeholders, i.e. Financial educators, Media outlets, Banks, etc.

As per data, 47% spends on OTT platforms are by Gen z

Digital Financial behaviuor can be extended beyong banking and apps

Saving Behaviour

Spending Behaviour

Cash flow management

Insurance Behaviour

Investment Behaviour

Credit Management

Primary

Potential

Secondary

Audience (18-26 year olds)

Parents/ Guardians

Educational Institutions

(High Schools & Colleges)

Banks (Public and Private)

Financial Educators

Personal Finance apps

Ministry of Finance (eg. SEBI, Financial Schemes)

Reserve Bank of India (content for Farmers, Small entrepreneurs, School children, Self Help Groups and Senior Citizens)

Media Outlets (financial influencers on Social media, Finance news channels)

NGOs (awareness programmes in rural areas & for EWS)

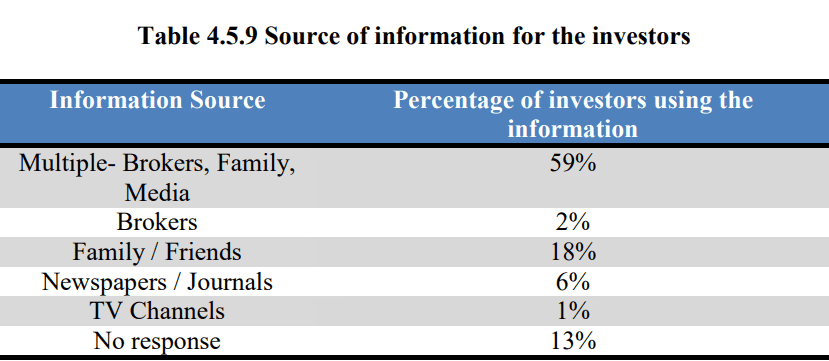

Mutual fund sahi hai is a campaign by the AMFI (Association of Mutual Funds in India) to position mutual funds as a preferred investment option for potential investors. With everyday situations as a backdrop, the campaign promotes mutual funds as the right investment option for prospective investors. Also, The campaign aims to educate the common public about mutual funds and dismisses the myths around them.

Today, the industry enjoys approximately 12% penetration. While products, distribution and a track record of performance have helped this increased penetration, the impact of AMFI’s efforts and campaign cannot be undermined. It has definitely helped rope in a broader segment and geography of investors, into the category.”

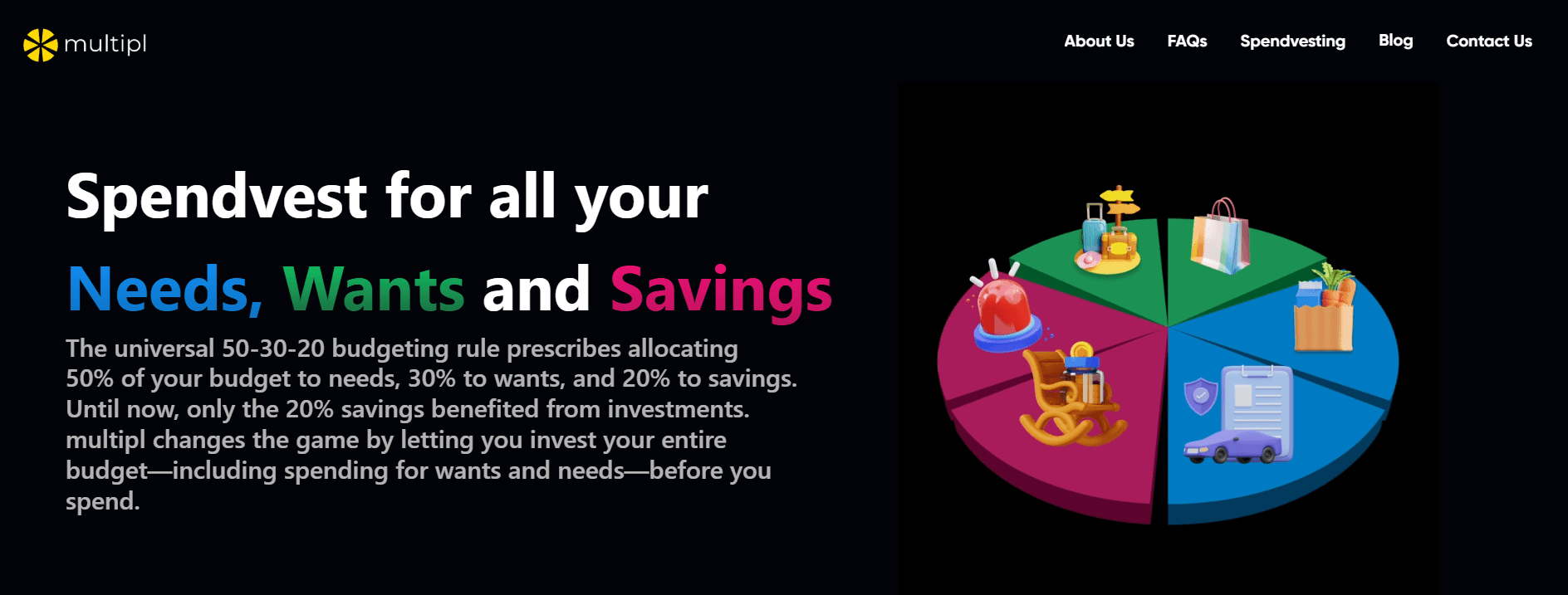

Spendvesting is an innovation combining lifestyle spending with prudent investing. This strategy involves expert-backed investments in short-term debt/ hybrid mutual funds and/or do-it-yourself (DIY) investments in digital gold and mutual funds targeted towards a range of lifestyle spends such as travel, gadgets, cars, insurance, etc.

Leveraging investment returns and additional savings through partner brand contributions, this model presents a significant commercial opportunity. It effectively caters to contemporary consumer desires for financial acumen and lifestyle fulfillment, potentially redefining spending habits.

Gen z are the largest demographic in India right now

43% consumption spending is by them

70% of them look forward to ‘NEW’

They are 1.6 times likelier than millenials to act on causes

They like immersive visuals

47% spends on OTT by gen z

They have a ‘Live in the moment’ mindset

Inclination towards recreation and indulgence

Pleasure focused approach to life

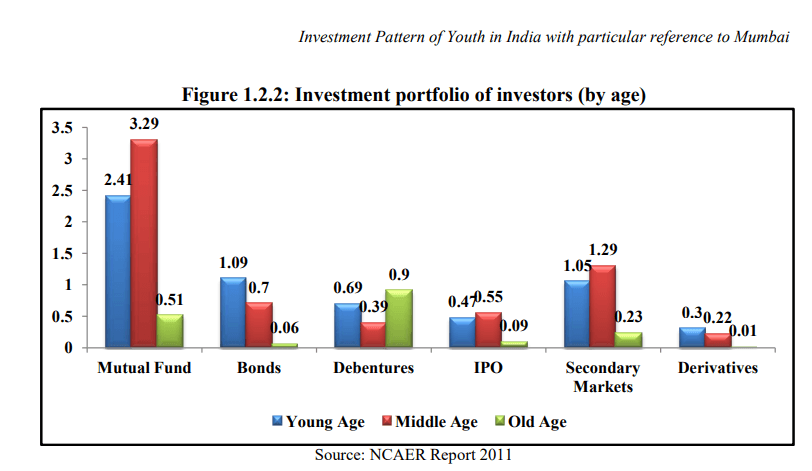

Prefer Mutual Funds and SIPs due to attractive returns with lower lock-in and easy withdrawal

Gold is also an option after Mutual Funds

They want Quick returns

Prefer small recurring investments

They want to invest but lack confidence or knowledge

Credits ~ Anarock - CONSUMER SENTIMENT SURVEY, 2022

Intent

Awareness

Simplification

Generating Interest

Creating Necessity

Context

India

Year 2024 - 30

Gen Z (age 18-26)

Urban population

Impact

Addressing the issue of financial illiteracy among young adults in India, to foster Economic Growth & Stability.

This was a self-driven project which focused on taking ownership of a design project from start to finish. Students were expected to recognize and articulate their design process and positioning within a chosen domain, demonstrating an understanding of a design solution's workability and practicality. Key deliverables included thorough research, strategic process, and a lo-fidelity final artifact.

Many young adults are unable to perform essential life skills, such as management, finances and household responsibilities, due to prolonged dependence on their parents, leading to challenges in their personal and professional development. Having a personal interest in finance, I chose to combine my knowledge of finance with design to create an efficient and practical solution for improving financial literacy among Gen Z in India.

29.4% of urban population in India is financially illiterate (Priyadarshi Dash & Rahul Ranjan, 2023). Financial literacy can help individuals improve their financial status and well-being by making informed decisions in creating household budgets, saving plans, managing debt, planning for life cycle needs, and dealing with unexpected emergencies without incurring unnecessary debts.

Defining Constraints

Anchor Points

The project was based on 3 major pillars. The final deliverable was created considering the financial and behavioural patterns of Gen z, the opportunities that the stakeholders can explore and the scope of Digital Financial Management Behaviour. The design solution was created after thorough research on all three anchor points.

Gen Z

Digital Financial

Behaviour

Stakeholders

Financial Habits of Gen Z

Quantitative evidences of Gen Z's financial habits

India’s youth have traditionally been seen as commitment-phobic, especially when it comes to long-term financial decisions like purchasing real estate. Culturally, buying a home was once viewed as a milestone achieved through years of saving, typically closer to retirement. As a result, majority of homeowners in India still fall within the 45–55 age group or older. Historically, younger individuals have remained largely aloof from investing in property, preferring more flexible lifestyles.

However, this began to shift in the 2000s, when banks started aggressively targeting the younger demographic with easily accessible home loan options. This made it possible for people in the 35–45 age group to enter the real estate market earlier than previous generations, signaling a gradual change in the spending and saving habits of India’s youth.

Values and Behaviours of Gen Z

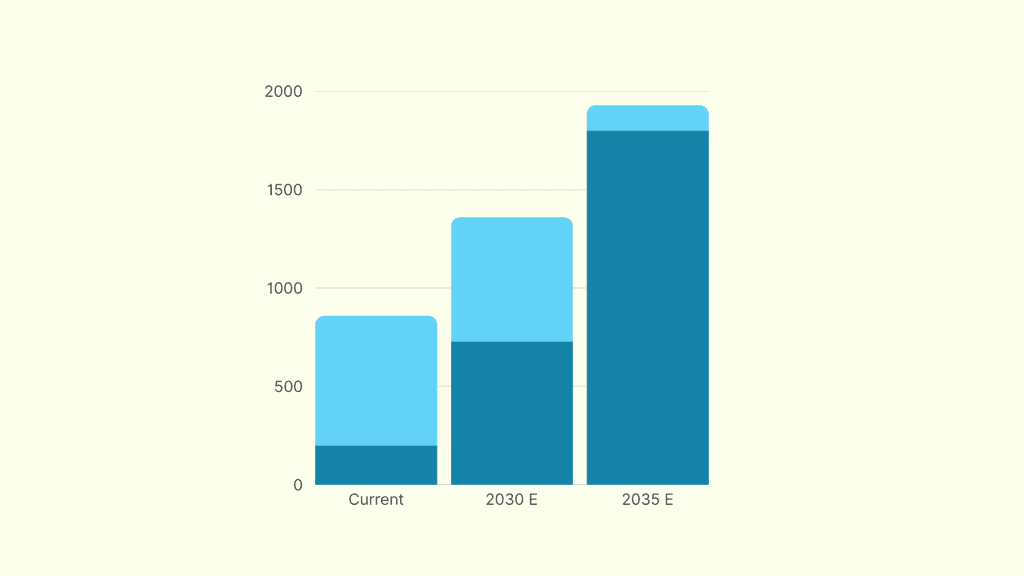

$660B

$200B

$630B

$730B

$130B

$1.8T

$2.0T

$1.4T

$860B

Patterns and Mindsets of Gen Z

Spendvesting

Mutual Funds Sahi Hai!

Gen Z

Stakeholders

Digital Financial Management Behaviour

DFMB refers to the set of indicators of financial behavior in multiple dimensions like household income and cash flow, credit, savings and investments, insurance, retirement, and estate planning displayed while planning, implementation, and evaluation of financial matters using digital platforms like the internet, robo-advisers, PFM apps, artificial intelligence, etc.

Scope of DFMB

Spending behavior, Investment behavior and Saving behavior have strong impact on DFMB of young adults in NCT of India

India also has the highest proportion of people thinking their economy will go cashless compared to other countries surveyed.

Indians are becoming more conscious of the need of financial planning. In future more and more people in India and around the world would display growing DFMB on routine basis.

Surveys conducted in most countries, showed a low level of personal financial literacy in developing countries.

Rampant poverty, lack of saving and inability to meet ends with available meager resource in developing countries justify the need for enhancing personal financial capability of individuals in developing countries.

Financial behavior and financial habits are among the ones that have been most profoundly impacted by digitization

When India switched from cash to sending payments to biometric smart cards, internal fraud and leakage from pension payments de creased by 47%.

Promoting online payments could increase the use of digital financial services by people who already have accounts, it also assist business owners in establishing alternative credit information histories, and encourage formalization.

PFM solutions are especially alluring to younger and unengaged" customers who might not have a good grip on personal finance fundamentals.

Data on Financial Inclusion

The manifestation for the project is created considering the spending, investing and behavioural patterns of Gen z, the opportunities that the stakeholders can explore and the scope of Digital Financial Management Behaviour

Gen Z

Digital Financial

Behaviour

Stakeholders

Booklets by RBI

Incentives by Banks

Competitions by

Education Institutions

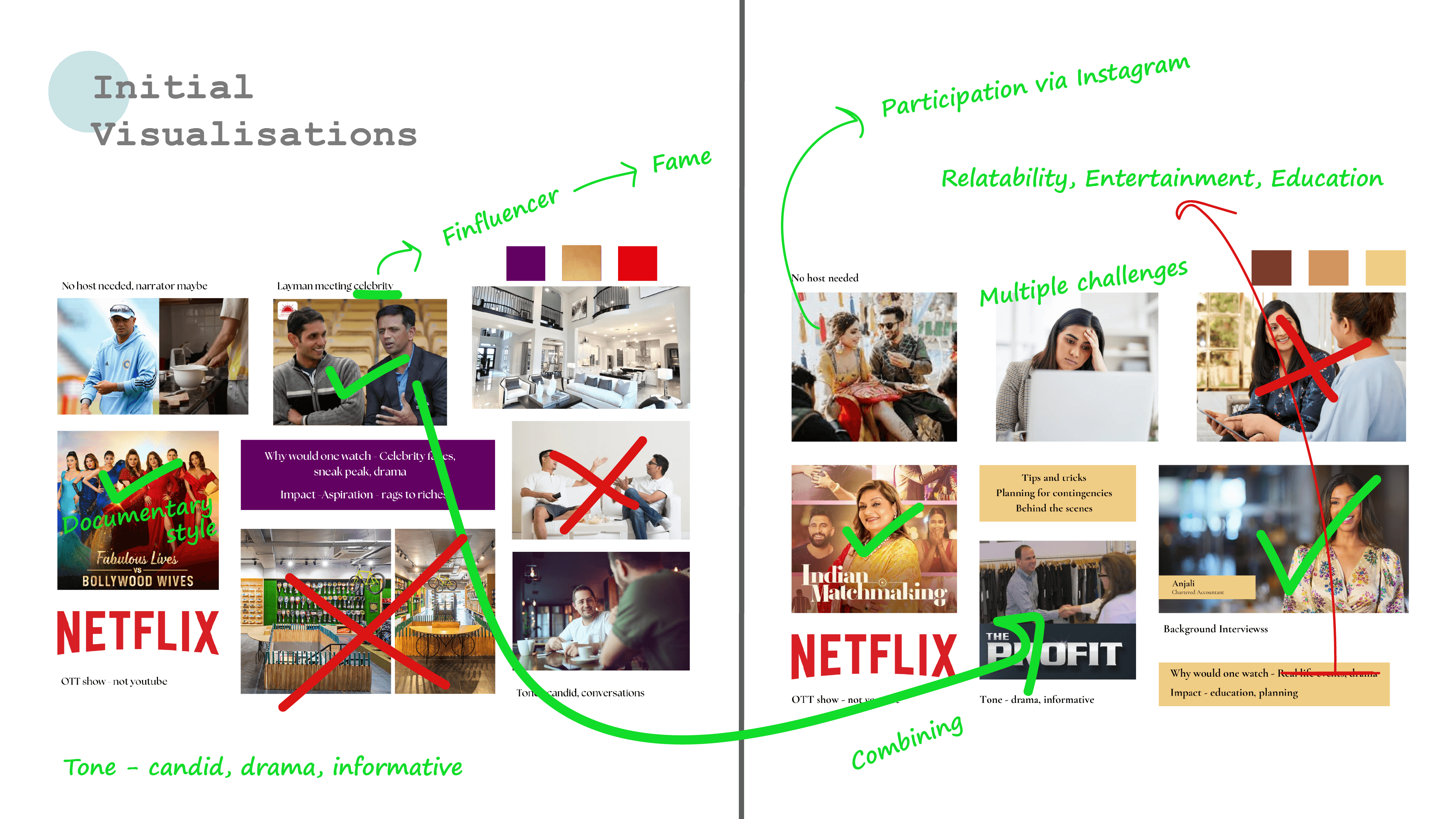

The following ideas were rejected as they do not cater to all the pillars of the project

The final design solution is an OTT show to enhance financial literacy among Gen Z in India. By blending relatable storytelling with practical advice, it addresses digital financial habits and stakeholder perspectives, making finance accessible, engaging, and relevant for young adults shaping their financial futures.

Digital Financial

Behaviour

Stakeholders

OTT

Show

Brief

.

.

Process

.

Ideation

Conceptualisation

.

Visualisation

.

Formulating a design solution for improving financial literacy among Gen Z in India

Show me the

Project Type

Academic

Domain

User Experience

Time Frame

10 weeks

money!

Other projects to explore